oregon college savings plan tax deduction 2018

Learn How Our Plan Can Help You Save Money. All Available Prior Years.

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

1 2018 the state income tax deduction for contributions made to a CollegeAdvantage 529 plan doubles from 2000 to 4000 per beneficiary per year.

. As we mentioned in an earlier post Congress made changes to 529 education plans. Ad File Late Taxes Today With Our Maximum Refund Guarantee. The new tax credit would be in addition to any carried forward deductions.

The benefit of contributing to an Oregon College Savings Plan account is that your account earnings have the opportunity to grow tax-free and so long as the money in your. Ad Why Invest in a Vanguard 529 Plan. Oregon doesnt allow an exten-sion of time to pay your tax even if the IRS is allowing an extension.

4750 is the maximum deduction couples can take per tax return per year. Oregon tax payers can receive a state income tax deduction. Contact a Fidelity Advisor.

A short digital video to highlight the tax savings when you open an Oregon College Savings Plan for your child. Setting Up a Vanguard 529 Plan Early Can Save You Money on Education Costs. There is also an Oregon income tax benefit.

Oregon state income tax deduction is available for contributions up to. With the Oregon College Savings Plan your account can grow with ease. 2016 Schedule OR-529 Oregon 529 College Savings Plan Direct Deposit for Personal Income Tax Filers.

And anyone who makes contributions can earn an income tax credit worth 150 for single filers or. With the Oregon College Savings Plan your earnings can grow tax-free. Oregon 529 college savings plan nonqualified.

The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. Oregon College Savings Plan Tax Deduction 2018 TGF Productions. Tax benefits that make a difference.

Since 2000 the yearly deduction has been set at a maximum of 2000 per account but the New Year. Starting January 1st 2020 the Oregon College Savings Plan is moving to a tax credit. Beginning on Jan.

If you file an Oregon income tax return contributions made to your account before the. Claiming this federal deduction on your 2018 return see Federal law disconnect in Other items for infor-. Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan.

All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon. Oregon college savings plan. By Springwater Wealth Feb 27 2018.

Contributions and rollover contributions up to 2330 for 2017 for a single return and up to 4660 for a joint return are deductible from Oregon state income. If you make a withdrawal from an Oregon College Savings Plan account or Coverdell ESA IRS Form 1099-Q is a tax form that youll receive that details all of the. Ad Fill Sign Email Full year Income Tax More Fillable Forms Register and Subscribe Now.

Free prior year federal preparation Prepare your 2018 state tax 1799. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College. Ad Why Invest in a Vanguard 529 Plan.

Your 2018 Oregon tax is due April. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a. Go Paperless Fill Sign Documents Electronically.

State tax benefit. Federal tax law No extension to pay. Currently you can contribute until your account balance.

6 Oregon College Savings Plan Disclosure Booklet4 There are no other recurring fees if one chooses to manage the account online and receive statements and withdrawals electronically. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. Minimum contributions if you use payroll deduction are only 15.

The Oregon College Savings Plan offers another tax benefit. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College. Learn How Our Plan Can Help You Save Money.

Setting Up a Vanguard 529 Plan Early Can Save You Money on Education Costs. Your 2017 Oregon tax is due April 17 2018. The Oregon College Savings Plan and Tax Reform.

They can then carry forward the remaining 10135 balance of that contribution for up to four years. For 2019 individual taxpayers are allowed to deduct up to 2435. And if youre using it for higher education expenses your savings.

529 Plan Advertisements And Marketing Collateral

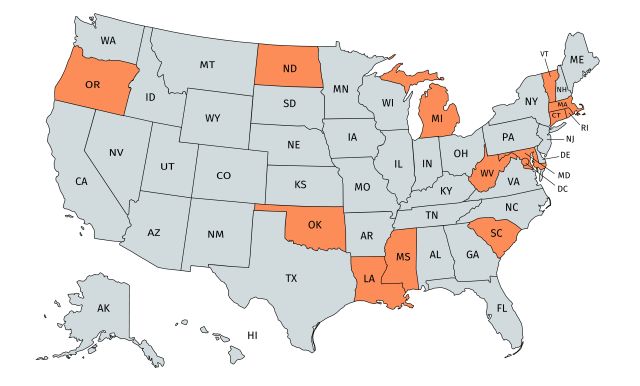

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

How Does Divorce Affect 529 College Savings Plans Shapiro Law Firm

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Oregon Won T Allow 529 Tax Breaks For K 12 Private School Oregonlive Com

529 Plan Deductions And Credits By State Julie Jason

529 Plans Without The Fossil Fuels Alternative Energy Stocks

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

The Best 529 Plans Of 2022 Forbes Advisor

5 Charts Tracking Recent 529 Savings Plan Trends Morningstar

Can I Use A 529 Plan For K 12 Expenses Edchoice

5 Charts Tracking Recent 529 Savings Plan Trends Morningstar

Gifting Faqs Oregon College Savings Plan

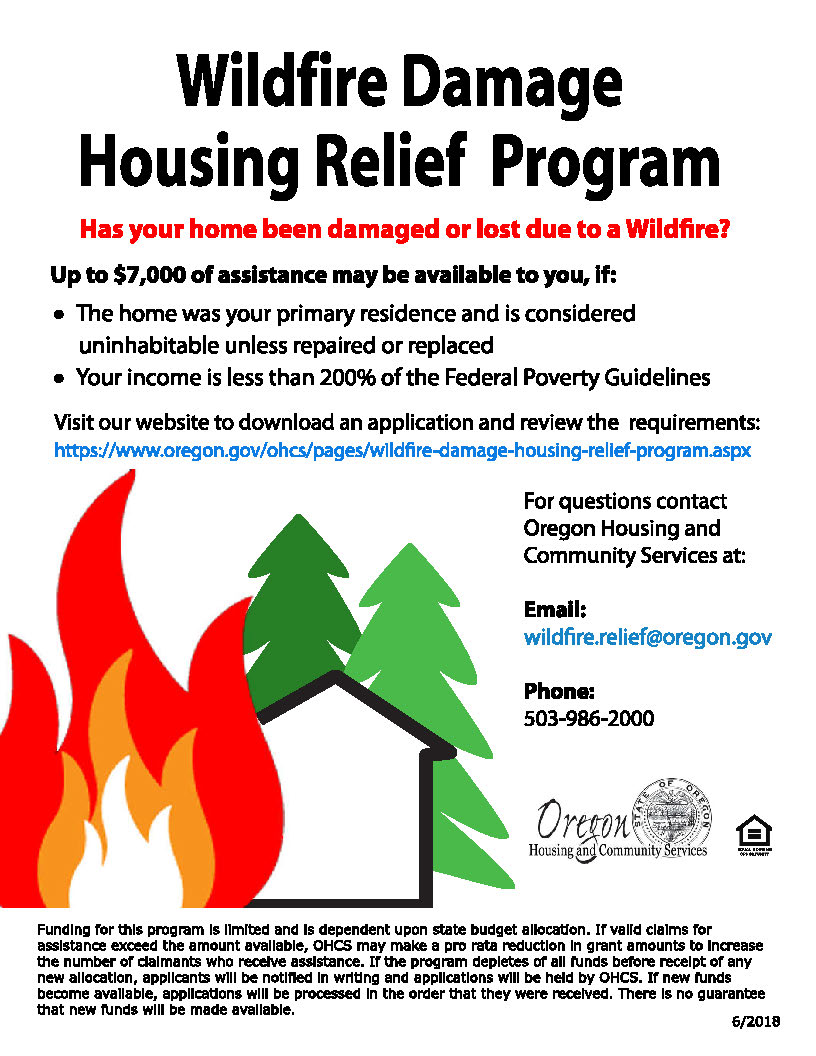

Wildfire Housing Relief 529 Savings Plan Updates State Fair More

:max_bytes(150000):strip_icc()/PrivateCollege529Plan-0408a91482914cfb957348bfc19dd36b.jpg)

:max_bytes(150000):strip_icc()/OregonCollegeSavingsPlan-4977e352c0014ce3993beb4e0832e733.jpg)